Home of Australia's

Crypto-Backed Loans

Borrow AUD using Bitcoin, Ethereum or Stablecoins with Australia's leading crypto loan platform.*

Trusted by thousands of Aussies. See how much AUD you could borrow with our Crypto-Backed Loans Calculator.

Crypto-Backed Loans

Borrow AUD without selling crypto

Block Earner is Australia’s leading Crypto-Backed Loans provider. Buy a home, get a crypto car loan or consolidate debt with a BTC, ETH or stablecoin secured AUD loan.

Borrow from $50 up to $5 million AUD within 24 hours, using your crypto as security. Choose fixed interest rates with a Line of Credit or Fixed Term loan*. Enjoy flexible repayment terms that let you repay your Bitcoin-backed loan or Ethereum-backed loan on your own schedule, while keeping exposure to crypto price movements.

Here's how Australia's Crypto-Backed Loans work:

Maintain your crypto exposure

Borrow up to $5 million AUD within 24 hours*

30-day grace period to restore LVR if needed

No early repayment fees, repay using crypto or AUD

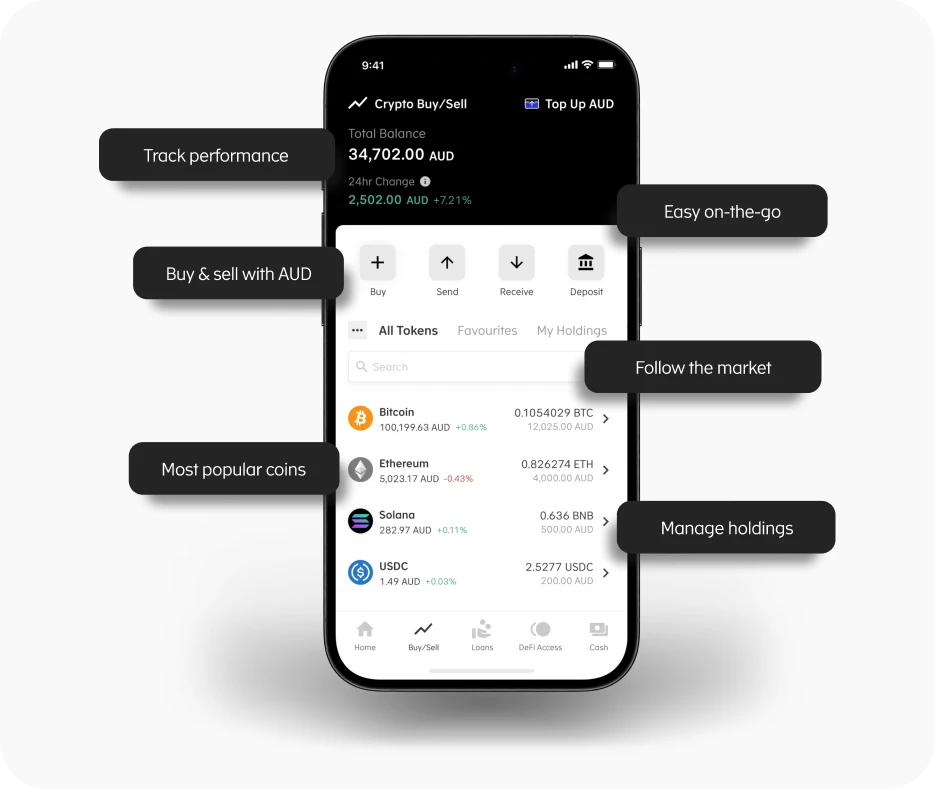

Buy, Sell & Trade Crypto

Trade 350+ coins with AUD

Crypto should not be complicated. Block Earner offers a fast and easy Australian crypto platform to buy, sell and trade Bitcoin, Ethereum and 350+ supported cryptocurrencies with AUD.

Block Earner is the easiest way to trade cryptocurrency in Australia. With competitive crypto trading fees, Block Earner provides a simple and cost-effective Australian app to buy, sell and manage your crypto holdings.

How do I buy cryptocurrency in Australia? Sign up in minutes.

Buy crypto with fast AUD deposits and withdrawal options via bank transfer and PayID. Check cryptocurrency prices in AUD and manage your portfolio with crypto buy/sell for Australian individuals, businesses and SMSFs.

About Block Earner

Founded in 2021, Block Earner is Australia's home of crypto-backed loans, and a trusted Australian cryptocurrency exchange. We're proud to offer an all-in-one crypto app that lets Australians buy and sell cryptocurrency, and borrow AUD using their Bitcoin, Ethereum and stablecoins.

With a focus on security, excellent service, low rates and everyday utility, we empower Australian individuals, businesses and Self-Managed Super Funds by providing crypto lending and blockchain finance for smarter financial decisions. Trade crypto and more with Block Earner, Australia's leading platform for crypto loans.

For more information, please contact us today.

- 2025 Winner - Finder Innovation Awards Most Innovative Team

- 2025 Winner - Finder Innovation Awards Digital Assets & Web3 Innovation

- 2025 Winner - Finder Innovation Awards Tech Innovation

- 2025 Winner - FinTech Australia Finnies Excellence in Web3 (Blockchain or Crypto)

- 2024 Winner - Digital Economy Council of Australia Blockies Financial Services Innovator of the Year

- 2024 Winner - WeMoney Lending Innovation of the Year

- 2024 Winner - FinTech Australia Finnies Excellence in Blockchain/Distributed Ledger

- FinTech Australia

How to borrow using crypto?

Download loans guide

Borrow from $50 up to $5 million AUD, within 24 hours.* Download our crypto-backed loans guide or book a call and speak to our team.

WeMoney Winner

2024 Lending

Innovation Of The Year*

- 1.Sign Up

Open your account

- 2.Get Verified

Verify your identity

- 3.Move Your Money

Get started in minutes

Available on iOS & Android

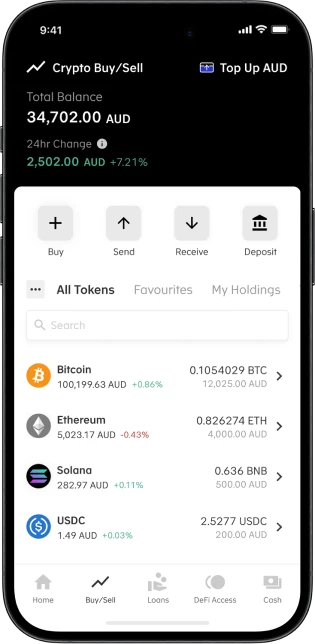

The easiest way to buy

Bitcoin with AUD

Buy, sell and trade crypto. Borrow AUD. All in one app.

Download App

Frequently asked questions

- Block Earner is an Australia-based FinTech powered by blockchain technology. We offer Crypto-Backed Loans, Crypto Exchange (Buy & Sell over 350 coins), DeFi access, Cash Account, SMSF, OTC and more.We are registered with AUSTRAC as a digital currency exchange provider and operate under an authorised representative arrangement of an Australian Credit Licence holder. Block Earner is also a member of Digital Economy Council Australia (DECA) and Fintech Australia.

- To create your Block Earner Account follow these easy steps:

- First, decide on your account type: Personal, Business or SMSF

- Verify your email, phone number & ID. This should only take a few minutes.

- Deposit AUD or crypto from another exchange/wallet

- Explore all our product features to see what’s right for you

- KYC (Know Your Customer) is a mandatory identity verification process required by financial regulations. You need to complete KYC to help protect against fraud, money laundering, and other financial crimes. Verifying your identity also helps ensure that only verified individuals can access Block Earner, and supports industry standards for fraud and AML risk mitigation. By following KYC requirements, businesses and financial institutions comply with the law and create a safer environment for everyone.

- PersonalAustralian Passport, or: Drivers LicencePrivate CompanyCompany Extract from ASIC (up to 2 months old). We require Company Extracts of any parent company or any company that owns more than 20% shares. Bank Statement (up to 2 months old) showing business name, business address, and bank account details.Sole TraderBank Statement (up to 2 months old) showing business name, business address, and bank account details. A copy of your Australian passport or a drivers licence (back and front page)SMSFTrust Deed (certified over the past 12 months). If Trustee is a company, Company Extract from ASIC (up to 2 months old). We require Company Extracts of any parent company or any company that owns more than 20% shares. Bank Statement (up to 2 months old) showing business name, business address, and bank account details.TrustTrust Deed (certified over the past 12 months). If Trustee is a company, Company Extract from ASIC (up to 2 months old). We require Company Extracts of any parent company or any company that owns more than 20% shares. Bank Statement (up to 2 months old) showing business name, business address, and bank account details

- There is a minimum deposit/withdrawal amount of $1 to and from your Block Earner Cash account.

- Depositing AUD into your Block Earner account can take up to 24 hrs for your first transaction. Please also note: Some banks have longer delays, you can read our blog of crypto-friendly banks here.If you experience delays from your bank, we recommend calling your bank to lift any deposit blocks or delays.

Newsroom

Latest News & Announcements

Supported Coins

Trade 350+ Cryptocurrencies

Get in touch

Contact us

Additional information

*Approved applicants only. Terms, conditions, fees and charges apply. *The rate provided above is indicative and your rate may be different based on a variety of factors, including your credit worthiness. Rates are subject to change. ^The comparison rates are based on a secured loan of $10,000 over a term of 3 years. The comparison rate provided includes a 2% origination fee. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Credit provided by Web3 Loans Pty Ltd ACN 668 516 952 and managed by Web3 Ventures Pty Ltd trading as Block Earner (ACN 655 090 869) authorised representative 551024 of Mortgage Direct Pty Limited ACN 075 721 434 Australian Credit Licence 391876. *Capital is not covered by the Australian government deposit guarantee. For more info please see ourTerms of Use and FAQs. Winner of 2024 WeMoney Lending Innovation of the Year award for our Crypto-backed Loans. Winner of 2024 FinTech Australia Excellence in Blockchain/Distributed Ledger, Winner of 2024 Digital Economy Council of Australia 'Blockies' Financial Services Innovator of the Year, Winner of 2025 FinTech Australia Excellence in Web3 (Blockchain or Crypto), Winner of 2025 Finder Innovation Awards Most Innovative Team, Tech Innovation and Digital Assets & Web3 Innovation. NB: These awards are for Block Earner's full suite of products and not specifically the Crypto-Backed Loans product.