AUD Loans

Borrow using USDT

See how much could I borrow ->

Loans from

9.50

Interest rate*

11.93

Comparison rate*

Maintain crypto exposure

Borrow up to $5m AUD

No lock-ins, repay anytime

Introducing crypto loans — what are they, and how to use them for

Gone are the days of approaching a bank or lender for a loan. If you're a USDT holder, you may be eligible for a USDT-backed loan with Block Earner. Using your crypto as security, you'll be able to:

Borrow up to $5 million AUD within 24 hours of approval

Access AUD funds of up to 80% of your USDT's value

Manage your loan and LVR within our app

Discover a new wave of lending and submit your application with us today.

USDT-backed loans:

Fixed Term or Line of Credit

Choose a Fixed Term loan for 3-5 years with a predictable repayments, or opt for a Line of Credit for up to 1 year, allowing you to repay on your own schedule. Enjoy easy access to funds, and retaining your crypto exposure.

Line of Credit rate of 9.50% (11.93% comparison rate*)

Fixed Term rate of 11.50% (12.17% comparison rate*)

Access both loan options conveniently in a single app

Min. Monthly repayments

$0.00 AUDRepay at anytime*

Origination fee

$0.00 AUD2% of loan amount*

Maximum interest

$0.00 AUD12 month loan term, assuming no early repayments*

- Total Interest

- 2% Origination Fee

- Loan Amount

*Approved applicants only. Terms, conditions, fees and charges apply. *The rate provided above is indicative and your rate may be different based on a variety of factors, including your credit worthiness. Rates are subject to change. ^The comparison rates are based on a secured loan of $10,000 over a term of 3 years. The comparison rate provided includes a 2% origination fee. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Credit provided by Web3 Loans Pty Ltd ACN 668 516 952 and managed by Web3 Ventures Pty Ltd trading as Block Earner (ACN 655 090 869) authorised representative 551024 of Mortgage Direct Pty Limited ACN 075 721 434 Australian Credit Licence 391876.T&Cs apply.

- 1.Sign Up

Open your account

- 2.Get Verified

Verify your identity

- 3.Borrow AUD

Buy or deposit crypto to get started

How to borrow using crypto?

Download guide and book a call

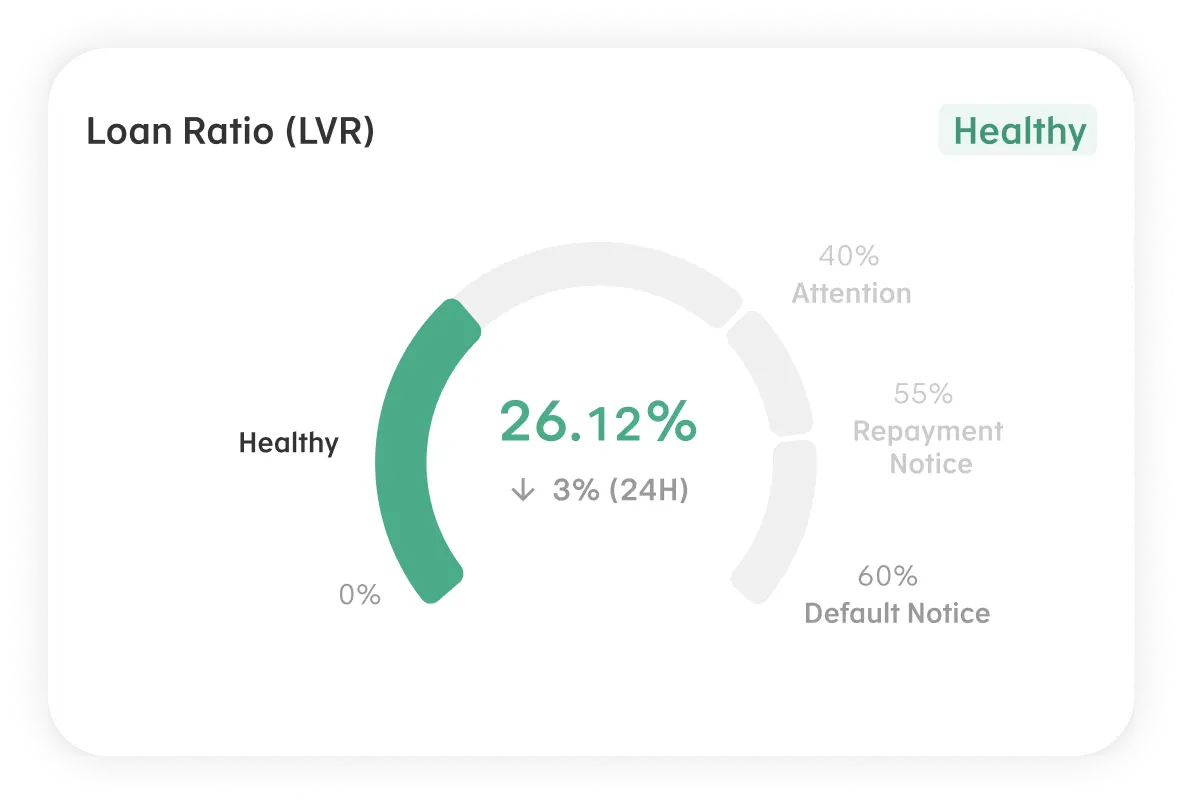

We've made it easy to stay on top of your USDT loan. You'll be able to view your balance, make loan repayments, manage your loan-to-value ratio (LVR) and access helpful resources all in one place.

WeMoney Winner

2024 Lending

Innovation Of The Year*

Make your Stablecoins go further with a USDT-backed loan

Access up to $5M AUD with rapid approvals and flexible repayments, all within one app. Manage market fluctuations with confidence and stay in control.

30-day Default Notice to restore LVR if needed

Avoid crypto sell-offs, temporary dips won't trigger action

Maintain your assets if prices rebound

Car upgrades

Buy your dream car, or cover unexpected costs

Travel

Pay for travel whenever you require a getaway

Debt consolidation

Simplify and manage your debt more effectively

Home improvement

Buy, redesign and renovate the place you call home

University

Invest in your education to build a bright future

Weddings

Handle the expenses for any special occasion

How does it work?

You can borrow AUD without selling your crypto. Once approved, AUD will be sent directly to your bank account within 24 hours.

You can manage your loan ratio with AUD or crypto. You have the flexibility to repay your loan on any schedule or in full the end of the 12 month period.

Stay on top of your LVR with in-app notifications, emails and SMS updates. We will also send you a weekly update about the status of your loan.

Borrow AUD

Borrow AUD using the USDT as security.

Rapid approval times

Get your borrowed cash fast, and direct to your bank account.

Competitive fixed rates

At the end of each month, any unpaid interest will be added to the balance of the loan.

Maintain crypto exposure

By using Crypto-Backed Loans you maintain exposure to crypto price movements.

Avoiding crypto sell-offs

If your loan goes into default, natural-person borrowers have 30 days to repay AUD or add crypto security to restore the health of their loan. If no action is taken within this period, Block Earner may automatically sell a portion of your crypto security to bring your LVR back to 55%.

Unlock your

digital assetsUse your cryptocurrency as security to borrow AUD without having to sell your digital assets.

Get AUD

within 24 hoursGet your borrowed cash fast, and direct to your bank account.

Flexible

repaymentsFlexible repayment terms provide access to funds when you need them most.

Protected with

FireblocksFireblocks is an ISO and SOC2 certified digital asset custodian.

Australian

Credit LicenseAuthorised Representative (551024) offered under Australian Credit License (ACL 391876).*

Newsroom

Latest News & Announcements

Supported Coins

Trade 350+ Cryptocurrencies

Get in touch

Contact us