Corporate

Using Bitcoin Security: The new strategy for unlocking property wealth

16 Jul 2025

Block Earner unveils Australia’s first Bitcoin-backed home loan, enabling crypto investors to access the housing market without selling their Bitcoin

16 July 2025, Sydney – Block Earner, one of Australia’s leading digital asset fintechs, has launched the country’s first Bitcoin-backed home loan, allowing crypto holders to use Bitcoin as security for deposit finance to enter the property market while maintaining their Bitcoin market exposure.

As Bitcoin reaches new price highs and cements its role as a globally recognised store of value, a growing cohort of digitally native Australians is unlocking the idle equity of their long-term crypto holdings. Block Earner’s new model reflects a broader shift in how wealth is stored, measured, and applied, signalling the beginning of a more inclusive approach to financial

eligibility.

With the total Australian crypto market estimated at A$91.43 billion (1) in 2025, and an estimated 3.9 million Australians (2) holding crypto in 2024, with personal holdings sitting at approximately A$20–22 billion, the asset class is becoming too large to ignore. Bitcoin alone accounts for more than half of the Australians’ crypto holdings.

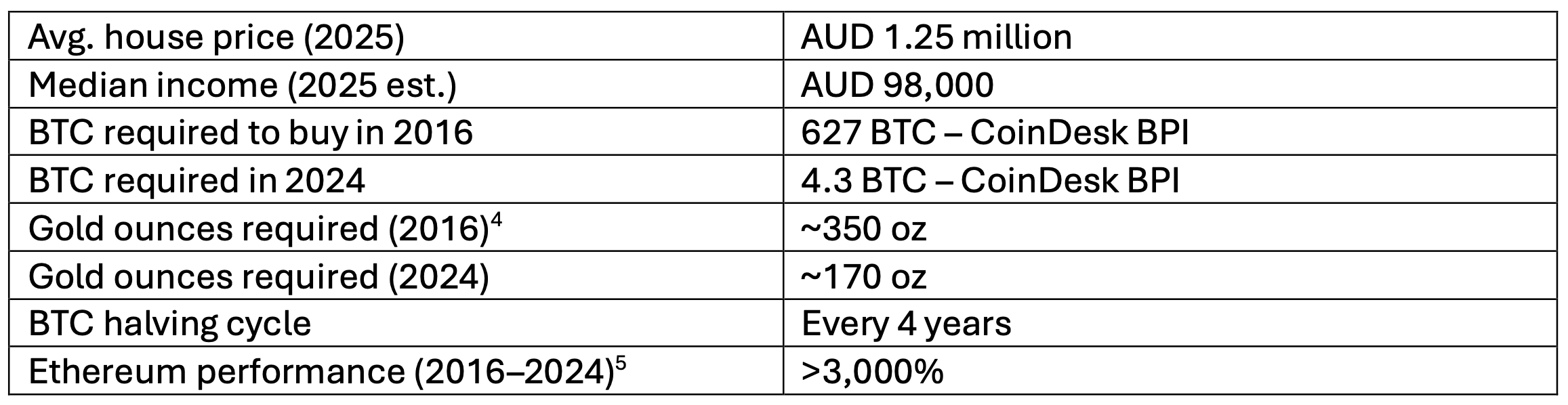

A better way to measure affordability — in Bitcoin and gold

Traditional affordability metrics, based on wage growth and Australian dollar figures, suggest a worsening housing crisis. But when homes are priced in inflation-resistant assets such as Bitcoin and gold, the picture shifts, and long-term holders of these assets may find their relative purchasing power has increased.

In 2016, the average Australian home cost 627 BTC or approximately 350 ounces of gold (3). By 2024, that had dropped to just 4.3 BTC or approximately 170 ounces of gold. This tells us something critical: while property values have soared in fiat terms, they’ve become more affordable when measured against stores of value with fixed, or slowly expanding supply and increasing institutional demand.

For investors who have built long-term exposure to assets like Bitcoin, and historically, gold, their relative purchasing power has significantly increased, even amidst broader affordability pressures.

That’s why crypto-backed lending makes sense: when an asset outpaces inflation, and property merely keeps pace with it, using Bitcoin to access real assets isn’t just viable, it's strategically sound.

The future of financial eligibility

Block Earner’s product also signals an emerging evolution in how the finance sector assesses

creditworthiness. Traditionally, lenders have prioritised salary, cash savings, and superannuation, overlooking how younger Australians are building and holding wealth.

“This is a turning point for both property finance and digital assets,” said Charlie Karaboga, CEO and Co-Founder of Block Earner. “Crypto holders shouldn’t have to choose between holding Bitcoin and buying a home. We’re giving them a smarter option, a way to put their crypto to work without giving it up. This product isn’t just innovative, it’s inevitable.”

By recognising Bitcoin as a legitimate asset class, Block Earner is broadening the definition of assessable wealth, without compromising borrower protection or lending discipline. Thanks to Bitcoin’s divisible nature, Block Earner can more precisely account for its value during the assessment process. Borrowers also have the flexibility to use their Bitcoin security to partially

or fully offset loan repayments if they choose.

Momentum is also building globally. In the US the Federal Housing Finance Agency (FHFA) recently announced it is considering allowing borrowers to use crypto as part of their federal mortgage applications, without converting it to cash. It’s another sign that traditional finance is evolving to meet the asset realities of modern investors.

The model: how it works

Block Earner’s Bitcoin-backed home loan product provides an inclusive, asset-backed path from

Bitcoin holder to homeowner. This structure allows eligible borrowers to enter the property market without liquidating their Bitcoin, while preserving upside exposure:

- Borrower applies via Block Earner’s platform

- Bitcoin (BTC) is transferred into Institutional-Grade custody

- A cash loan is issued against the Bitcoin, covering up to 50% of the property value. Typically used to fund the deposit component.

- A traditional mortgage lender finances the remainder, through a standard home loan.

- The Bitcoin backed deposit loan could be borrowed interest-only for up to four years, with principal repayable in crypto, cash, 6. Borrowers can exit the Bitcoin loan with Block Earner at any time without penalty.

The product allows prospective homeowners to not only enter the property market without selling their Bitcoin, but for many, also avoid costly LMI.

Block Earner does not lend Bitcoin security to 3rd parties. Borrowers’ Bitcoin is held in institutional-grade custody via Fireblocks, one of the most secure custodians globally.

Who is this for?

This product is designed for digital natives holding Bitcoin, looking to preserve digital asset exposure while acquiring property.

It reflects a broader wealth trend: as digital asset-based finance matures, investors are increasingly seeking ways to integrate digital assets into conventional wealth strategies.

Market momentum

Although the product has only soft-launched, early briefings have triggered strong interest from potential borrowers, accumulating over $110 million in mortgage demand. Block Earner has commenced a national roadshow, with sessions already held in Sydney and further events scheduled in Melbourne, Brisbane and Perth.

Formal lending partnerships are in late-stage discussion, with rollout plans aligned for later in 2025.

ENDS

Key Metric Data

Metric value

(1) Expert Market Research - https://www.expertmarketresearch.com.au/reports/australia-

cryptocurrency-market

(2) Swyftx Crypto Survey 2024 - https://swyftx.com/wp-content/uploads/2024/09/swyftx-cryptocurrency-

survey-2024.pdf

(3) Gold pricing data sourced from USAGOLD, which aggregates historical gold prices based on

benchmarks set by the London Bullion Market Association (LBMA), the globally recognised standard for

gold pricing.

(4) Gold pricing data sourced from USAGOLD, which aggregates historical gold prices based on

benchmarks set by the London Bullion Market Association (LBMA), the globally recognised standard for

gold pricing.

(5) Ethereum price performance based on data reported by CoinDesk and major exchanges, including

CoinMarketCap and TradingView.

About Block Earner

Block Earner is a leading Australian fintech bridging traditional finance and blockchain technology. It offers innovative, user-friendly financial products that allow Australians to access and use digital assets confidently.

Block Earner is a registered Digital Currency Exchange and Independent Remittance Provider with AUSTRAC, and is an authorised Australian Credit Licence Representative of Mortgage Direct Pty Ltd.