Crypto-Backed Loans

Partner with Us

Our B2B2C crypto-backed loans allow borrowers access loans in local fiat currency, without selling crypto.

See how we can work together

Powering up your crypto-backed loans

Block Earner supports BTC, ETH, XRP, USDC and USDT-backed loans. Borrowers can maintain exposure to potential upside while unlocking liquidity. Loans are issued in AUD (for the Australian market) or equivalent USD for US partners.

From plug & play to fully custom API integration

Annual percentage rate (APR)*

11.93% p.a.

Fixed rate for 12 month

Interest rate*

9.50% p.a.

Fixed rate for 12 month

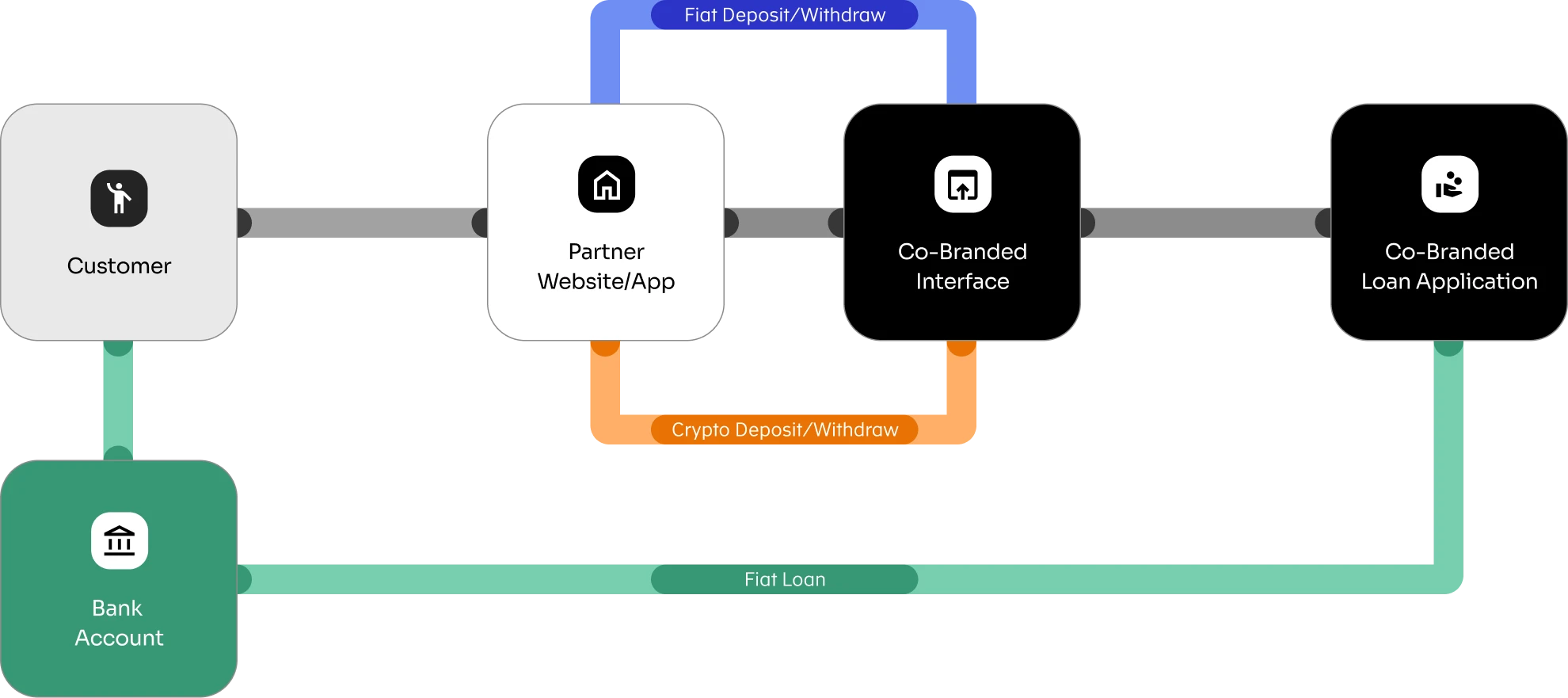

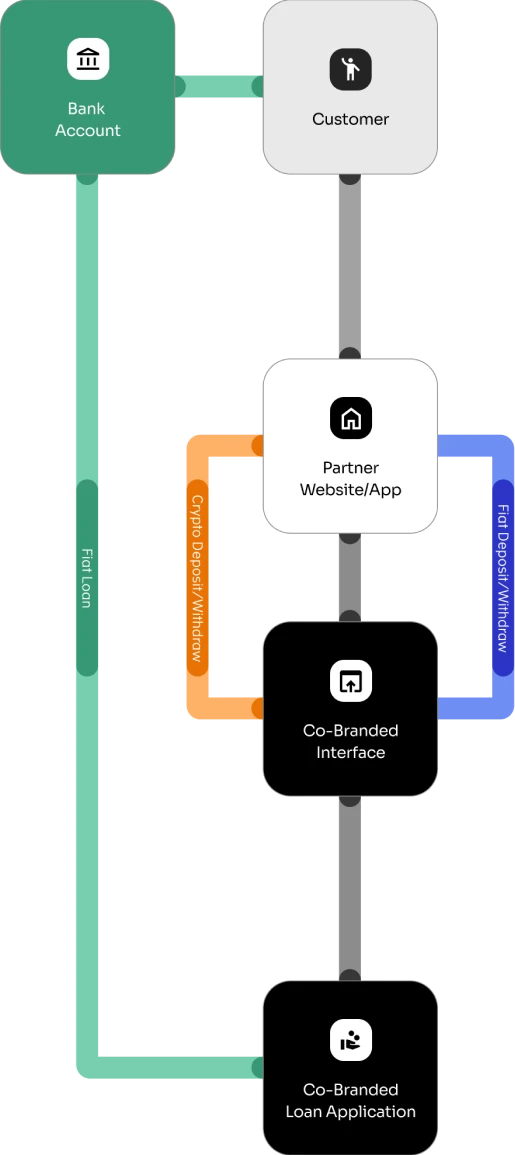

Black Label: Co-Branded

Plug-and-Play Interface

Ideal for a quick-to-market lending solution

Users login as normal through your platform, are redirected to the co-branded portal upon clicking on Loans in-app. They can deposit and withdraw cash and crypto, apply for loans and manage repayments within the co-branded experience. Gain a new revenue line while serving your customers more comprehensively.

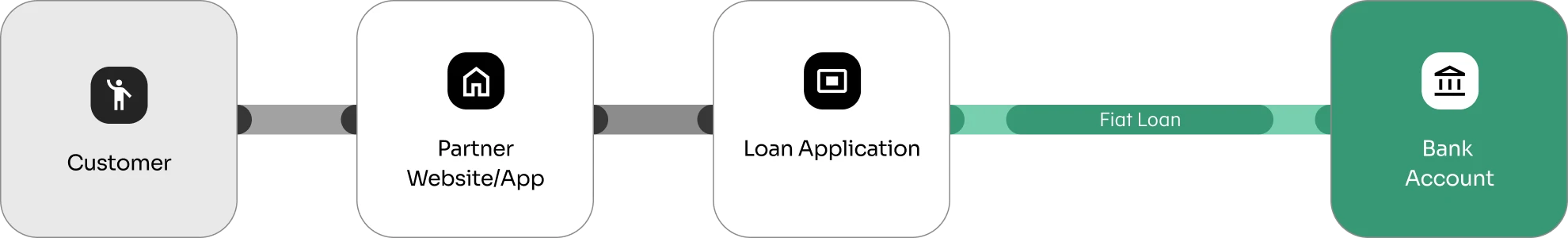

White Label: Fully Custom

API Integration

For full control of the user experience

Allows partners to build a completely native UI/UX while Block Earner powers the backend via APIs. Customers never leave the partner's app; they apply for a loan and manage repayments within the platform's own interface. Block Earner handles loan origination, risk management and custody.

Crypto → Local fiat currency

Let your customers borrow up to $10 million within 24 hours of approval. Block Earner makes it easy for customers to manage their loan-to-value ratio (LVR), track their loan balance, and repay using dollars or crypto.

Supported coins

Supported coins

Borrowers have access to real-time dashboards showing outstanding balances, collateral value and LVR health. Automated alerts notify users to repay with cash or top up collateral when market movements raise the LVR.

Product market fit

Crypto-backed lending meets both user and business needs. Offering loans helps to drive trade volume, attract new users and generate market agnostic revenue.

Liquidity without selling

Users access fiat currency without selling assets, maintaining their crypto exposure.

Top up & redraw

Users can easily top up crypto collateral or redraw more cash if crypto value increases.

Low fees & fixed rates

Users understand upfront fees and costs, with repayment flexibility and no exit fees.

Flywheel revenue

Partners generate consistent revenue through loan originations (2%) and interest repayments.

Attract new users

Loan customers are 150%+ more valuable, more engaged, and more loyal.

Go to market fast

Launch in weeks, not months with plug & play co-branded or API integrations options (3-6 months).