Unlock your Dream Home with a

Bitcoin-backed Home Loan

Join the Waitlist Now!

Claim a $1,000 IKEA Voucher

Available to the first 500 approved loans.

T&Cs apply.

Access a home deposit up to $5 million, save thousands on LMI

Maintain crypto exposure, pay interest-only for up to 4 years

Block Earner handles your deposit, our lending partner handles your mortgage

How the Home Loan

application works

Follow these simple steps to unlock your crypto's potential and secure your home deposit. Provide your crypto details and mortgage details below to join the waitlist. We're here to guide you through the process.

Crypto details

Enter your crypto details to see how much you could borrow with your Bitcoin-backed home loan.

Step 1

Loan details

Share details about your loan purpose and financial position so our lending partner(s) can assess how much you could borrow.

Step 2

Pre-approval

Block Earner and our lending partner(s) will assess your loan application, and update you on the next steps.

Step 3

The Process: From Bitcoin

to home ownership

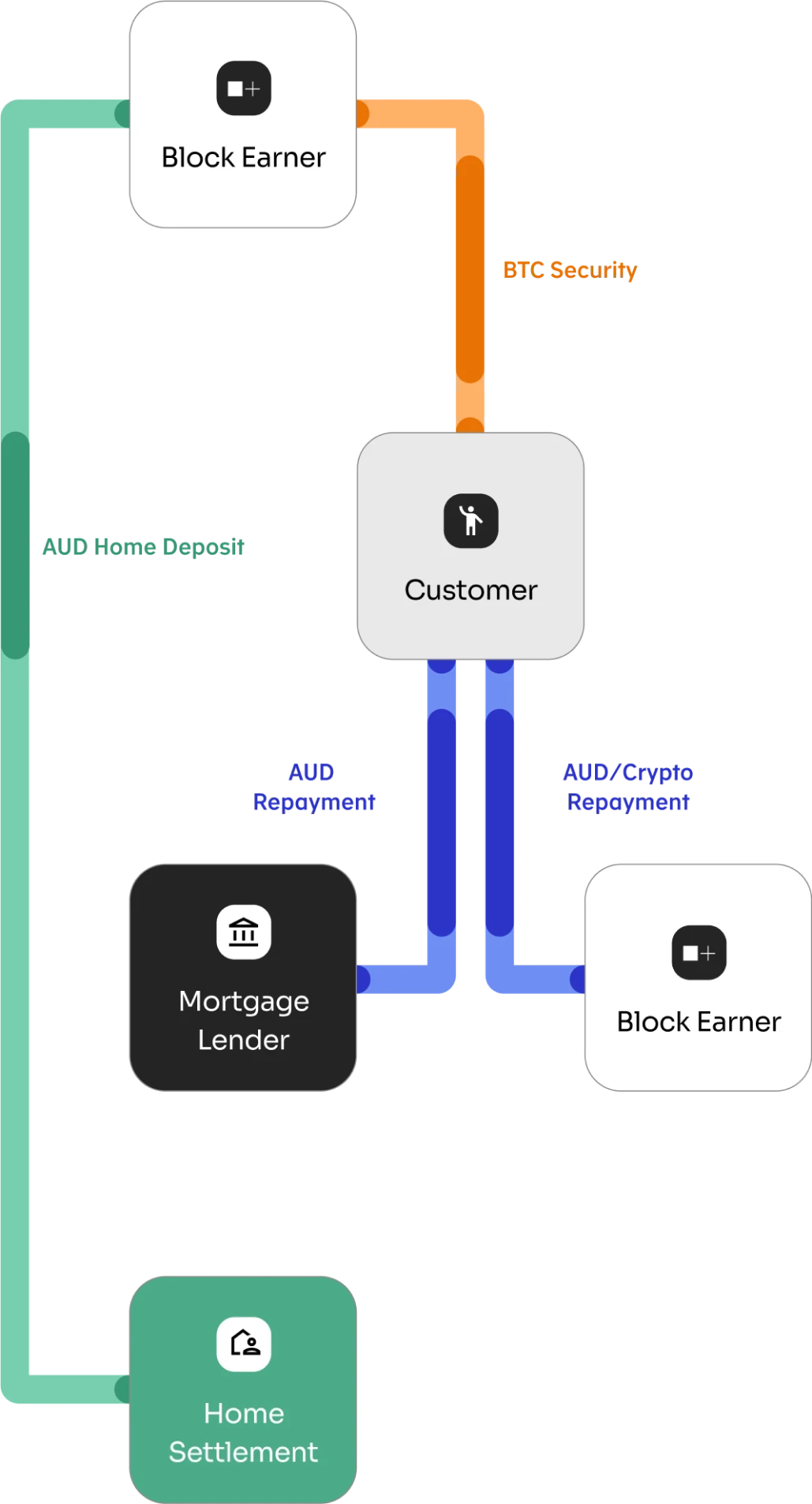

Your Bitcoin security unlocks AUD from Block Earner. Over time, you repay the loan to Block Earner using AUD or crypto, while making regular AUD repayments to the mortgage lender. Here"s how it works:

Explore your options

with

Block Earner

Whether you're buying your first home, investing in property, or refinancing, our Bitcoin-backed home loans could help you unlock the value of your crypto to make your financial goals a reality.

Own your dream home

Saving up 20% of a dream home can be a long journey. Unlock value in your crypto to top up your deposit and potentially save big on LMI.

Investment in property

Not every home you buy you have to live in. Release equity from your Bitcoin holdings to gain exposure to the property market.

Refinance and save

Repaying your home loan early is a common goal. Releasing equity from your crypto can help you pay off your loan sooner and save on home loan interest.

Flexible interest

repayment options

Repay your loan with flexible options, including AUD repayments monthly or quarterly, weekly crypto sales, or a combination of AUD and crypto.

Repay interest with AUD

Repay your interest with AUD by choosing monthly or quarterly instalments, tailored to suit your financial preferences and cash flow needs.

Sell crypto to repay interest

Choose to sell your crypto to repay your interest. A hassle-free way to manage your loan on your terms. Enjoy a frictionless repayment process that works for you.

Repay with AUD and crypto

Enjoy the freedom to repay your interest in a way that suits you. Choose to repay with AUD or crypto, seamlessly switching between both options.

Newsroom

Latest News & Announcements

Supported Coins

Trade 350+ Cryptocurrencies

Get in touch

Contact us