Market Update

Is it easier or harder to write newsletters when Bitcoin is at an all time high? On one hand there is the temptation to say “I told you so” to everyone, the other hand says “stay humble, who knows what tomorrow will bring”.

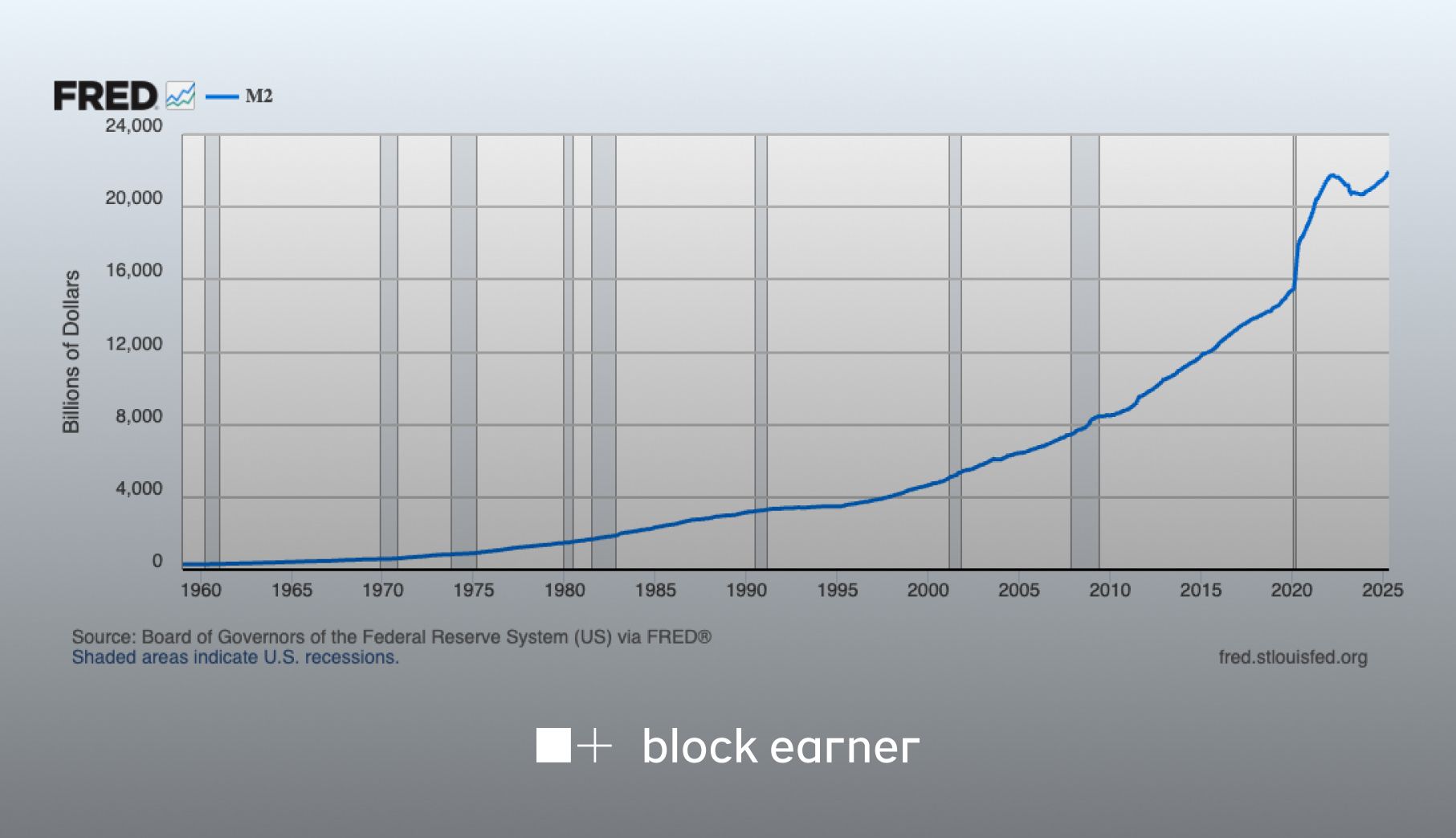

As we get further into the pro-crypto Trump administration we’re noticing interesting data points appear. Notably, the BTC price is correlating extremely closely with M2 money supply minus 80 days. Meaning it takes about 80 days for new money supply to filter through the system to Bitcoin buyers, also meaning people are favouring BTC over holding said “new cash”.

Even with the positive action on Bitcoin, dominance (BTC’s share of the overall market) took a hit in the last 48 hours. Altcoins are showing life again which is a general indicator of risk-on investors returning to the fray. In previous cycles, altcoin runs are far shorter and steeper than BTC ones but they typically top at a similar time. Take from that what you will.

Pump.fun (the memecoin launchpad on Solana) finally listed their long anticipated token. It has dropped 20+% since launch, perhaps indicating memecoin mania is finally behind us…a bit like NFTs. What’s next?

Letter from the trenches

BTC-Backed Home Loans - Join the Waitlist

With BTC reaching ATHs this week, there’s even more reason to join our waitlist. Purchase your dream home using BTC-while still benefiting from its potential upside.

Working Hard to Improve Your App Experience

Our team has been hard at work over the last couple of months to make your app experience even better.

We have exciting product upgrades coming your way… Watch this space!

Capital Brief: "Bitcoin-Backed Home Loans Are Really Coming to Australia This Year"

Journalist Daniel Van Boom writes "After winning a court fight with ASIC, Block Earner is pushing ahead with plans to allow Bitcoin owners to use their crypto as collateral to buy homes."

Crypto News

Why The US Could Become The ‘Crypto Capital of The World’ This Week

In what is being called "Crypto Week," the House of Representatives will consider the Guiding and Establishing National Innovation for U.S. Stablecoins, or GENIUS, as well as the Digital Asset Market Clarity Act, or Clarity for short. Congress is set to debate new US laws this week that could push cryptocurrency assets further into the mainstream, potentially adding to price momentum that drove bitcoin to a record high.

Fed Chair Jerome Powell Reportedly Considers Resigning

Over the past few months, we have seen President Donald Trump leading an intense campaign against “Too Late” Powell. He has time and again asked Powell to slash interest rates and even threatened to fire him multiple times. William Pulte, Chairman of the Board of Fannie Mae and Freddie Mac, said on July 11, “I’m encouraged by reports that Jerome Powell is considering resigning. I think this will be the right decision for America, and the economy will boom.”

What’s Been Driving the Bull Market in Crypto?

Institutional demand has been fuelling Bitcoin’s comeback, potentially shifting crypto from speculation to strategic investment. According to data, the current Bitcoin bull market hasn’t been driven by retail investors. Rather, it has been driven by those who ‘missed out’ on the previous bull cycles – the institutions. And now that institutional investors are involved, Bitcoin could be looking like it’s here to stay.

Disclaimer: The information contained in this blog is general in nature and is provided for informational purposes only. It does not constitute financial, legal, or tax advice, and should not be relied upon as such. Block Earner does not guarantee the accuracy or completeness of any information presented. You should consider your own personal circumstances and seek professional advice before making any financial or investment decisions. Past performance is not indicative of future results. All investments carry risk.